We asked over 100 leading accountants, bookkeepers and financial advisors on Orange Select, Receipt Bank’s global community for their 2021 trend predictions.

Several of this year’s accounting trends are responses to world events. Others represent an industry-specific movement to advisory. All are poised to drive the industry forward.

First, let’s start on a positive note.

1. 78% of accountants are optimistic that they’ll meet their 2021 goals.

The data was loud and clear. Nearly 8 in 10 (78%) accountants are optimistic that they’ll meet their 2021 goals.

After a challenging year, accountants and bookkeepers have been on the frontline of small businesses. We know that many have been working the midnight oil to support clients, making this data-point particularly hopeful.

So what are most accountants working towards?

2. Client retention and growth are top of the agenda.

When it comes to accountants’ priorities for the New Year, client retention and growth are at the top of the agenda. Around 42% accountants intend to focus on client retention next year, with over half (53%) targeting growth.

Other priorities include developing a happier work-life balance (10%) and enhancing efficiency with technology (18%).

The biggest challenge?

COVID-19 – specifically, adapting to the pre-vaccine environment over the next 12-24 months. In fact, over 30% of accountants said that COVID-19 related challenges (including lockdowns and economic impact) would be the biggest barrier.

Several respondents cited the need to stabilise clients’ businesses while finding new ways to market their firm in place of physical networking. And indeed, many accountants are now incorporating webinars and podcasts into their marketing strategies.

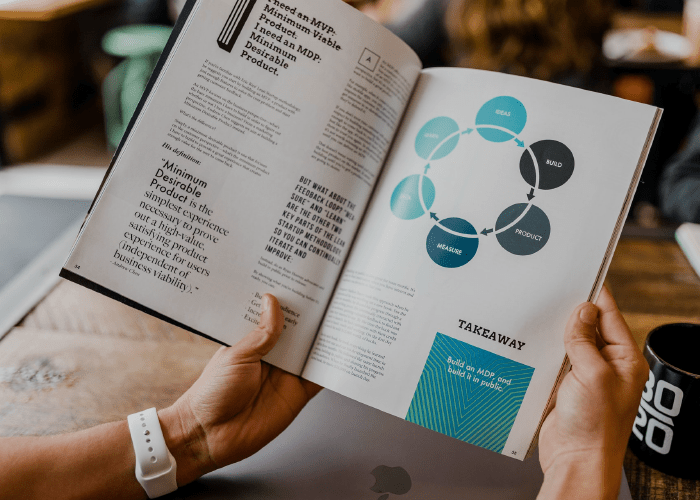

3. Advisory is the main growth driver for firms.

This year showed the necessity of not only offering cash flow forecasting services, but also actively recommending it.

60% of respondents said that advisory would be their key growth driver in 2021, with only 14% naming compliance. What’s more, 75% of accountants surveyed said that advisory would lead to growth in 2021.

Moreover, cash flow remains king. 60% said that financial advisory services would be in most demand from clients. Some are looking to increase advisory revenue to 25% of their overall turnover, while others are concentrating on the added value for clients – introducing new services such as tax planning and regular management reports.

4. More than two thirds (67%) are using or exploring technology to price advisory services.

Of course, one of the biggest challenges of delivering advisory services at scale is how to price effectively and profitably.

So how do you communicate the tangible, financial value of advisory work to clients?

This year, we’ve seen a huge rise in interest in pricing tools, with many sophisticated pricing product features coming to market. Now accountants know that they can easily rely on automation for their data entry, the next step is pricing.

When you have enormous amounts of client data, machine learning can quickly sift through, detect the anomalies and flag them to you or your staff. This is where tools like the Xavier Health Score come in. This provides an estimated health score on your client’s data, so you can accurately and effectively price work before you start.

5. Practice productivity is more important in uncertain times.

When asked for the tools needed to deliver on 2021 plans, 35% of respondents prioritised practice productivity product features. This is the second most-in demand feature after remote working tools (51%).

Payment technology comes third place (22%), with a small group of accountants also choosing fraud detection features (9%) and assurance technology (8%).

6. Zooming in on remote working: 1 in 2 accountants will work from home in 2021.

Remote working is here to stay. As the world moves in and out of lockdowns for the foreseeable future, more than half of accountants will continue to work from home.

Adapting to virtual service delivery will be essential, with technology playing a key part; over 50% of all accountants said that they’d prioritise remote working product features next year.

The World Economic Forum (WEF) Report (October 2020) mirrors our findings. The WEF report found that 85% of employers are set to rapidly digitise working processes. About a third of all employers expect to take steps to create a sense of community, connection and belonging among employees through digital tools, and to tackle the wellbeing challenges of remote work.

So, what next?

As we move into 2021, we are hopeful that everything the industry showed this year – the resilience, grit and determination to keep business going – positions accounting as an adaptable force for economic growth and stability. Accountants and bookkeepers truly are the front line for many businesses in times of uncertainty.

Source: Emma Pegg, These 6 Accounting Trends Will Define 2021, https://www.receipt-bank.com/blog/these-6-accounting-trends-will-define-2021/, Receipt Bank, November 30th 2020